Financing Options for Purchasing a Duct Forming Machine

- By:Metmac

- 2024-06-27

- 168

Investing in a duct forming machine is a significant decision that requires careful planning. While outright purchase is an option, many businesses opt for financing to spread out the cost and maintain cash flow. This article explores various financing options available for purchasing a duct forming machine, empowering you to make an informed choice that aligns with your financial needs and business objectives.

Leasing

Leasing offers a flexible solution for businesses that do not wish to commit to a long-term purchase. Under a lease agreement, the financing company retains ownership of the machine, while you pay regular lease payments for the use of the equipment. Leasing often requires a lower down payment compared to purchasing, making it a viable option for businesses with limited upfront capital. Additionally, lease payments may be tax-deductible, providing further financial benefits.

Equipment Loans

Equipment loans are specifically designed for financing capital equipment, including duct forming machines. These loans typically have longer terms than leases, allowing you to spread out the cost of the machine over a more extended period. Equipment loans offer competitive interest rates and provide ownership of the machine upon completion of the loan term. By financing the machine through an equipment loan, businesses can access the latest technology without depleting their capital reserves.

Vendor Financing

Many equipment manufacturers offer in-house financing options to their customers. Vendor financing can provide tailored solutions that align with the manufacturer’s recommended payment plans and equipment specifications. However, it is essential to compare terms and interest rates offered by vendor financing with other financing options to ensure the most competitive deal.

Credit Cards

Using a business credit card to finance a duct forming machine may be a viable option for short-term purchases or smaller machines. Credit cards often offer introductory interest-free periods, providing a cash flow advantage. However, it is crucial to manage the balance carefully to avoid high-interest charges and maintain a good credit score.

Government Programs

Government programs may provide financing assistance to businesses, including those looking to purchase capital equipment. These programs can offer low interest rates, extended terms, and even grants or tax incentives. Research available government programs that align with your industry and location to explore potential financing opportunities.

Factors to Consider When Choosing a Financing Option

When selecting a financing option, consider the following factors:

Cost: Compare interest rates, fees, and down payment requirements across different options to determine the total cost of financing.

Term: Decide on the appropriate loan term based on your repayment capacity and the lifespan of the equipment.

Flexibility: Consider whether you need a fixed payment schedule or the flexibility to adjust payments as your business grows.

Ownership: Determine if you prefer to own the machine after the financing period or return it at the end of the lease.

Tax implications: Explore the tax implications of each financing option and consult with a financial professional for advice.

By carefully evaluating these financing options and considering the factors outlined above, you can make an informed decision that optimizes your financial situation while enabling the acquisition of a high-quality duct forming machine for your business.

-

2027 Essential Guide to Choosing the Perfect Bold**Wood and Fabric Bed Frame** for Your Bedroom

2026/03/05 -

2027 Latest Trends in Wood and Fabric Bed Frames for Modern Bedrooms: Comprehensive Buyer’s Guide & Top Styles Breakdown

2026/03/05 -

Wood and Fabric Bed Frames: Pros, Cons, and 2027 Maintenance Tips You Need to Know

2026/03/05 -

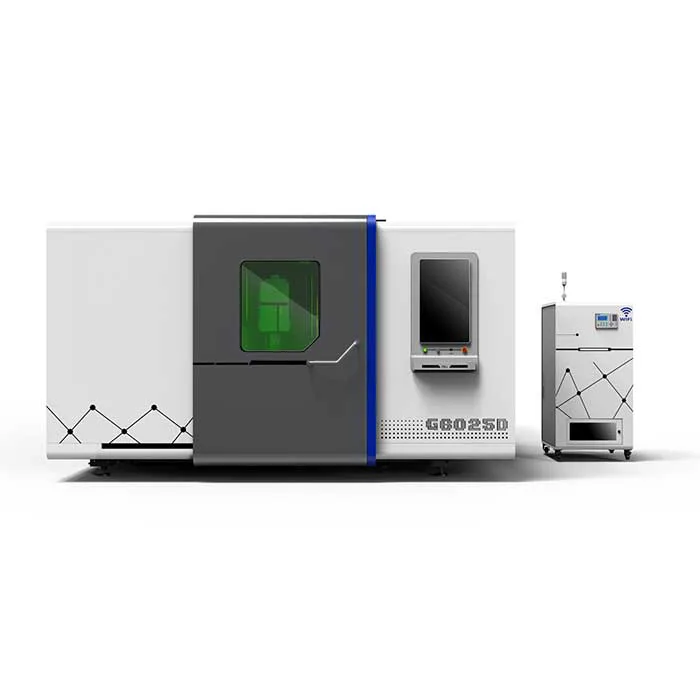

Iron Sheet Laser Cutting Machine: Unmatched Precision for Demanding Fabrication with METMAC

2026/01/06

-

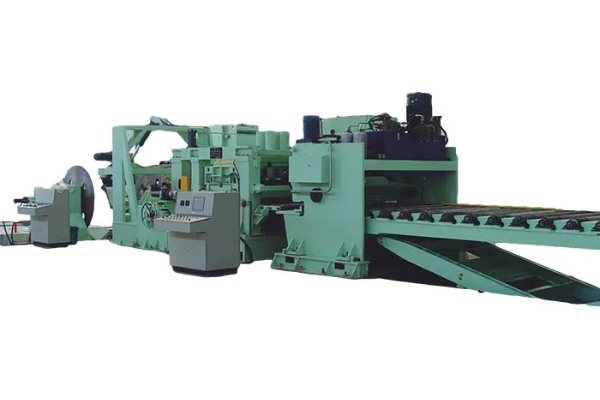

Advanced Sheet Metal Rolling, Laser Cutting, and Folding Machines for Precision Fabrication

2025/10/31 -

High-Performance Sheet Metal Bending and Cutting Machines for Modern Fabrication

2025/10/31 -

High-Quality Sheet Metal Equipment for Sale: Efficient Solutions for Modern Manufacturing

2025/10/31 -

High-Performance Sheet Metal Equipment for Sale: Forming and Shearing Solutions for Modern Fabrication

2025/10/22

-

A Guide to the Latest Innovations in Sheet Metal Folding Machines

2024/11/29 -

Key Features to Consider When Investing in a Sheet Metal Folding Machine

2024/11/28 -

Enhancing Precision with Advanced Sheet Metal Folding Machines

2024/11/27 -

How to Choose the Right Sheet Metal Folding Machine for Your Workshop

2024/11/26