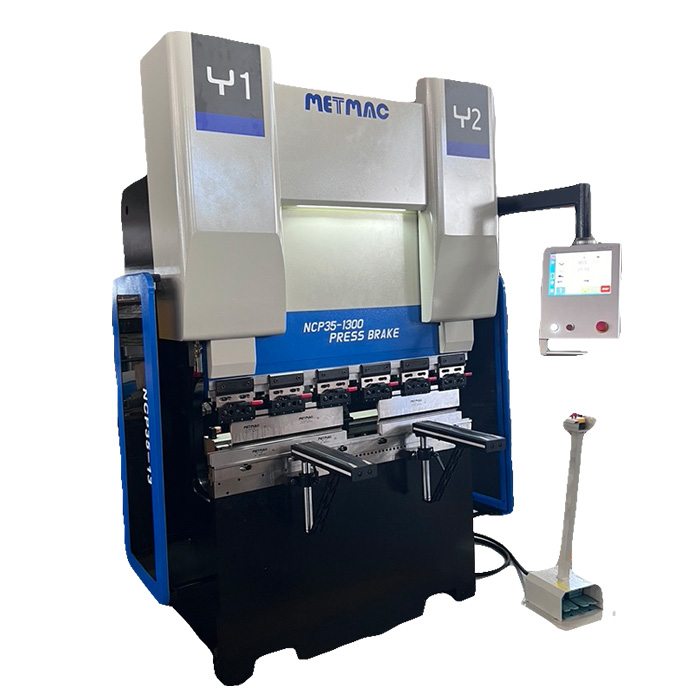

Financing and Leasing Sheet Metal Press Machines- What You Need to Know

- By:Metmac

- 2024-05-30

- 201

“Financing and Leasing Sheet Metal Press Machines: What You Need to Know” is a comprehensive guide that provides valuable insights into the various financing and leasing options available for sheet metal press machines. Whether you’re a seasoned manufacturing professional or new to the industry, this article will empower you with essential knowledge to make informed decisions about acquiring these critical pieces of equipment.

Types of Financing and Leasing Options

Equipment Financing

Equipment financing is a versatile option that allows businesses to purchase sheet metal press machines and other equipment without a significant upfront capital investment. Financing agreements typically involve monthly payments over a predefined term, ranging from a few years to several decades. Businesses can choose fixed or variable interest rates, depending on their financial situation and risk tolerance.

Equipment Leasing

Equipment leasing offers a convenient way to acquire sheet metal press machines on a temporary basis, often with shorter terms than financing agreements. With leasing, businesses can preserve their capital and spread payments over the equipment’s useful life. There are two main types of leases: operating leases and capital leases. Operating leases transfer the risk and ownership of the equipment back to the lessor at the end of the term, while capital leases effectively transfer ownership to the lessee.

Factors to Consider When Choosing

Selecting the optimal financing or leasing option requires careful consideration of several factors:

Capital Availability

Businesses should assess their available capital and determine if financing or leasing is the most suitable option. Financing requires a higher upfront investment but offers the potential for long-term ownership. Leasing may be more attractive for businesses with limited capital or who prefer to conserve cash flow.

Business Cash Flow

Financing and leasing agreements can significantly impact cash flow. Businesses should analyze their monthly cash flow to ensure they can comfortably meet the payment obligations. Financing agreements typically have higher monthly payments but may offer more flexibility in terms of scheduling. Leasing agreements may have lower monthly payments but may also restrict usage or require end-of-term payments.

Equipment Usage and Depreciation

The anticipated usage and depreciation of the sheet metal press machine should be taken into account. Financing agreements typically transfer ownership to the business, while leasing agreements do not. Businesses should consider the expected lifespan of the equipment and whether they intend to own it long-term or return it after the lease term.

Benefits of Financing or Leasing

Financing and leasing both offer unique advantages for businesses:

Benefits of Financing

Builds equity in the equipment

Potential for long-term ownership

Tax deductions for interest payments

Benefits of Leasing

Lowers upfront investment

Preserves capital for other expenses

Flexibility to upgrade or return equipment

Conclusion

“Financing and Leasing Sheet Metal Press Machines: What You Need to Know” provides a comprehensive overview of the various financing and leasing options available for these essential pieces of equipment. By understanding the types, factors to consider, and benefits of each option, businesses can make informed decisions that align with their financial capabilities and business objectives.

-

Iron Sheet Laser Cutting Machine: Unmatched Precision for Demanding Fabrication with METMAC

2026/01/06 -

Precision Metal Cutting Machine: The Engine of Modern Manufacturing, Powered by METMAC

2026/01/06 -

Sheet Metal CNC Laser Cutting Machine: Precision Redefined with METMAC Technology

2026/01/06 -

Sheet Metal Press Brake for Sale: Find Your Precision Bending Solution with METMAC

2026/01/06

-

Advanced Sheet Metal Rolling, Laser Cutting, and Folding Machines for Precision Fabrication

2025/10/31 -

High-Performance Sheet Metal Bending and Cutting Machines for Modern Fabrication

2025/10/31 -

High-Quality Sheet Metal Equipment for Sale: Efficient Solutions for Modern Manufacturing

2025/10/31 -

High-Performance Sheet Metal Equipment for Sale: Forming and Shearing Solutions for Modern Fabrication

2025/10/22

-

Integrating Automation with Rectangular Duct Machines for Enhanced Productivity

2024/05/11 -

Metal Shear Machines- Essential Tools for Precision Metal Cutting

2024/05/11 -

Understanding the Role and Function of Steel Strip Slitting Machines

2024/05/11 -

Maintenance Tips for Longevity of HVAC Duct Machines

2024/05/11

-

A Guide to the Latest Innovations in Sheet Metal Folding Machines

2024/11/29 -

Key Features to Consider When Investing in a Sheet Metal Folding Machine

2024/11/28 -

Enhancing Precision with Advanced Sheet Metal Folding Machines

2024/11/27 -

How to Choose the Right Sheet Metal Folding Machine for Your Workshop

2024/11/26